Stay Up to Date on the East Bay Market

Victorian and Edwardian Architecture in SF-With Pics!

|

Victorian & Edwardian Architecture in San Francisco

The text, chart and photos are all courtesy and permission of the San Francisco architect James Dixon: James Dixon Website. We are most grateful for his generosity in allowing us to use them. |

||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||

|

This link goes to architect James Dixon's complete overview, which was the basis for this article. It features short videos on each of the different Victorian and Edwardian styles mentioned above. Also included is a link to his overview of subsequent styles of San Francisco architecture: James Dixon on San Francisco Victorian and Edwardian Architecture James Dixon on San Francisco Architecture 1920 to Present And for those who find San Francisco history as interesting as we do, here are two other websites we've discovered filled with fascinating stories and photographs: |

||||||||||||||||||||||||||||||||||||||||||||

Luxury Homes Update

San Francisco Luxury Home Sales Soar

In San Francisco, no market segment has recovered as dramatically as that for high-end homes. There are a number of reasons for this: the general economic recovery, the huge local increase in high-tech wealth, an increase in the number of highly affluent foreign buyers, and the fact that, as a group, the affluent have profited most from the large rebound in stock market values in recent years. And then the general appreciation the city has experienced of 20% - 30% since 2011 has simply moved a lot of sales into a higher sales price category. Whatever the reason, there is an enormous amount of money sloshing around the Bay Area that is now being invested in homes—many of which are being purchased all-cash. At Paragon, we have seen an increase of over 100%, year over year, in the number of luxury home sales we have brokered so far in 2013.

In the first chart below, we are defining luxury homes as condos, co-ops and TICs selling for $1,500,000 and above (the vast majority of these are condo sales), and houses selling for $2,000,000 and above. These are relatively arbitrary thresholds since a $2,000,000 house in Presidio Heights can be a small-ish fixer-upper, while a home of that price in another neighborhood might be a pristine mansion. In the charts breaking down sales by neighborhood, we’ve added the price segment for houses of $1,500,000 to $2,000,000 since what is happening there is quite interesting as well.

San Francisco High-End Home Sales by District & Neighborhood

The first chart is for condo, co-op and TIC sales, and the three following are for house sales.

The neighborhoods listed are representative of one of the 10 Realtor Districts for San Francisco, so consider them as indications of the general area where the sales occurred. This analysis tracks sales reported to San Francisco MLS. A fair number of high-end homes sell “off-market” and are not reported, however we don’t believe these alter the general picture painted in the charts above.

© 2013 Paragon Real Estate Group

Overheated? Yes. Bubble? No. Stabilizing....Maybe.

|

Overheated? Yes. Bubble? No. Stabilizing? Maybe.

Many adjectives are used to describe San Francisco, but normal isn't a common one - and the same can be said about our real estate market. Even taking into account its tendency to be unusual in one way or another, this past spring's market was overheated by virtually any definition. Surging consumer confidence and huge buyer demand chased a deeply inadequate supply of homes for sale, abetted by interest rates so low that loans - factoring in inflation and mortgage interest deduction - were almost like free money. All this led to an extreme seller's market, a feeding frenzy and dramatic price appreciation. But not, in our opinion, a bubble. The Economist, one of the first to sound the alarm for the last bubble, sees no sign of a U.S. housing bubble, basing its conclusion upon historical comparisons of home prices with rents and incomes. Also, it is not unusual for the market to go somewhat crazy following a 4-5 year down cycle after all the repressed demand bursts forth - this happened in 1996-1997 too. Besides which, we are only about 18 months into the current recovery. Though real estate is susceptible to sudden economic and political shocks, in past cycles, recoveries have typically lasted at least 6-8 years before peaking. That doesn't mean there won't be any short-term market adjustments, up or down, for one reason or another, along the way. There are some signs of a normalizing market. After a year of declines, the number of new listings in the 2nd quarter was a little higher than the 2nd quarter of 2012. Though this inventory was quickly gobbled up and overall supply remains very low, it's a good sign more sellers are entering the market. Median prices may be leveling off after spring's big pop - it's still too soon to be sure, but summer often sees a cooling down. It's not welcome news to buyers, but interest rates have increased from extreme lows - though remaining very low by any historical scale. (See below: The Sky is Not Falling.) The distressed home segment, which always distorts markets, is disappearing in the city and declining everywhere. And new-home construction continues to increase: even though we won't see much of this new inventory until 2014 and later, it's a very positive sign. We have updated our home value maps to reflect spring's recent sales: San Francisco Neighborhood Values |

||||||||||||||||||||||

|

||||||||||||||||||||||

SF Neighborhoods Hit New Peak Values

San Francisco Neighborhoods Hit New Peak ValuesParagon Market Report, June 2013New highs in home prices have not yet been reached in every San Francisco neighborhood, but the majority has either regained the value lost since the 2008 market meltdown, or now exceeded the previous high points of 2006-early 2008. (Different neighborhoods peaked at different times, just as they are now recovering at different speeds). This does not mean that every property bought at the height of the bubble in feverish multiple-offer bidding wars has now regained peak value. Nor does it mean that values might not fluctuate or drop in future months due to seasonal and/or other economic factors. Though virtually every market in the country is now on a similar upward trajectory, San Francisco's has recovered more quickly than most in the Bay Area, state and country. The city's neighborhoods, with a few exceptions, were never hit as hard as most other areas by the tsunami of distressed property sales: our home values generally fell in the 15-25% range compared to huge declines of 40-60% elsewhere and so we have had less ground to recover. That said, the city has always been an exceptional real estate market and the confluence of economic factors both general (such as the lowest interest rates in history) and unique (such as the local, high-tech boom) jumpstarted and supercharged our recovery beyond most others. It should be noted that, looking at past recoveries in the early eighties and mid-nineties, it is not unusual once a recovery gets underway after years of recession and repressed demand, for the market to regain previous peak values within a couple years of the turnaround beginning. Recoveries often start with a dramatic surge and that is what has happened with this one. In this chart, one can see the recovery occurring everywhere, but most dramatically in San Francisco. For this analysis, we've calculated the 2013 SF median house sales price for the 5 months since the year began; if we looked at just the last 3 months (reflecting offers accepted in 2013, when the market accelerated further), the SF median house price jumps to about $1,000,000. (Note: State and national data sources are behind those we can access for the city, and the last median prices reflect that disparity.)

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

What Costs How Much Where in SF March-May 2013

What Costs How Much Where in San Francisco

A Survey of Recent San Francisco Home Sales March-May 2013

Below are samples of recent city home sales sorted by price point. The list is not comprehensive and the sales are not necessarily representative of typical neighborhood values. In real estate, the devil is always in the details, and the short descriptions below cannot convey the many objective and subjective criteria that make up value. Still, they give an idea of what one can (or, at least could in recent months) purchase in San Francisco.

Please call or email if you'd like further details and property photos for any specific sales.

As seen below, a large percentage of properties has been selling well over asking price: for example, in April, 90% of closed SF home listings sold, without going through any price reductions, at an average sales price 7.5% above list price. A red-hot market.

Abbreviations: BR=bedroom, BA=bath, DOM=days on market, LP=list price, sq.ft.=square foot/feet, HOA=homeowner's association, pkg=parking space(s). Room counts do not include bathrooms, garages, storage rooms or rooms built without permit (bonus rooms): a 2 BR/2 BA home with a formal dining room, a living room and a kitchen would be considered 5 rooms. With a combined living-dining room: 4 rooms. A family room or office would count as an additional room.

Besides the sales below, maps and neighborhood values reports can be found here.

$12,750,000. Pacific Heights on Jackson: the 4-level, 18-room, 7 bedroom/7.5 bath Hellman Mansion, originally designed and built by Julius Krafft in 1902; 11,500 square feet, 7 fireplaces, bay views, 2 car parking. 100 days on market (DOM), sold at 86% of original list price (LP) for $1109/square foot.

$12,375,000. Russian Hill on Francisco: 12-room, 7 BR/5.5 BA, 6050 sq.ft. mansion built in 1888; sweeping bay and city views, 4 view terraces, 2 car pkg. 70 days on market (DOM), sold at 92% of list price (LP) for $2045/sq.ft.

$9,500,000. Presidio Heights on Presidio Terrace cul de sac: 14-room, 5 BR/6.5 BA, 1911 Beaux Arts mansion formerly the home of Mayor Alioto; 8040 sq.ft., library, home theatre. 29 days on market (DOM), 106% of list price, $1182/sq.ft.

$7,000,000. Presidio Heights on Pacific: 1951, detached, 11-room, 5 BR/4 BA, contemporary home featured on 2012 AIA Tour; 4264 sq.ft.; park, bay and GG Bridge views; roof deck; wine cellar for 800 bottles; 2 pkg. 13 DOM, 108% of LP, $1642/sq.ft.

$6,500,000. Russian Hill on Green: 3-level, 5 BR/6.5 BA, penthouse condo built in 1986; 5600 sq.ft., panoramic bay views, private elevator, 3 pkg, $1500/month HOA dues. 44 DOM, 108% of list price (LP), $1161/sq.ft.

$5,500,000. Clarendon Heights on St. Germain: 3-story, 5 BR/7 BA, modern home; views from GG Bridge to Mt. Diablo, 5701 sq.ft., elevator, deck, 2 pkg. 45 DOM, 102% of LP, $965/sq.ft.

$5,500,000. Buena Vista Park: 5-story, 21-room, 6 BR/5 BA, Arts & Crafts mansion with no parking; 6000 sq.ft., au pair quarters, deck; views of bay, city and GG bridge. 56 DOM, 100% of LP, $917/sq.ft.

$3,000,000. Noe Valley on 26th Street: 9-room, 4 BR/3.5 BA, custom house; 3058 sq.ft., city and bay views, 2 pkg. 6 DOM, 108% of LP, $981/sq.ft.

$3,000,000. Pacific Heights on Pacific: 2-level, 3 BR/3.5 BA, Edwardian condo; bay view, exclusive deck, music room, library, 1 pkg, $387/month HOA dues. 18 DOM, 100% of LP.

$2,995,000. Marina on Avila: 12-room, 4 BR/4 BA house built in 1925; 3025 sq.ft. + 600 sq.ft. deck, seismic upgrades, 2 pkg. 14 DOM, 109% of LP, $975/sq.ft.

$2,875,000. St. Francis Wood on Santa Clara: 1917, 4 BR/4.5 BA, detached, Spanish-Med house on double parcel; 3948 sq.ft., ocean views, 2 pkg, $4300/year HOA dues. 15 DOM, 120% of LP, $728/sq.ft.

$2,550,000. South Beach on 1st: 2008, 5-room, 2 BR/2 BA, high-rise condo at One Rincon; "sky-level" bridge to bridge views, 1568 sq.ft., patio, 1 pkg, $854/month HOA dues. 20 DOM, 96% of LP, $1626/sq.ft.

$2,550,000. Alamo Square on Hayes: 1891, 4-level, 11-room, 5 BR/4.5 BA Victorian with in-law apartment; 3804 sq.ft., downtown views, no parking. 0 DOM, 98% of LP, $670/sq.ft.

$2,500,000. Noe Valley on Elizabeth: 1906, 7-room, 3BR/3 BA, "contemporary" house with studio-cottage; 2178 sq.ft., deck, hot tub, 2 pkg. 0 DOM, 125% of LP, $1148/sq.ft.

$2,495,000. Sea Cliff on Lake: 1921, detached, 11-room, 5 BR/3 BA, traditional home; 2860 sq.ft., 2 pkg. 22 DOM, 100% of LP, $872/sq.ft.

$2,450,000. St. Francis Wood on San Buenaventura Way: 1941, 11-room, detached, 5 BR/3 BA, traditional home; 2 pkg, $2376/year HOA dues. 26 DOM, 111% of LP.

$2,060,000. Cole Valley on Stanyan: 1910, 9-room, 4 BR/2 BA house -- legally a 2-unit bldg; 2183 sq.ft. + bonus rooms and bath, deck, 2 pkg. 21 DOM, 122% of LP, $944/sq.ft.

$2,050,000. Dolores Park on Church: 2-level, 8-room, Art Deco, 3 BR/3 BA, penthouse TIC in 6 unit bldg; 2749 sq.ft., 3 pkg, downtown and bay views, private patio and garden, $575/month HOA dues. 34 DOM, 103% of LP, $746/sq.ft.

$2,025,000. Inner Richmond on 10th: 8-room, 4 BR/2.5 BA, 1911, detached Edwardian; 2770 sq.ft., 2 pkg. 53 DOM, 107% of LP, $731/sq.ft.

$2,007,000. Glen Park on Laidley: 3-level, 4 BR/3 BA, modern house built in 1997; 2600 sq.ft., 2 pkg. 6 DOM, 115% of LP, $772/sq.ft.

$2,000,000. Lake Street on Lake: 9-room, 4 BR/2.5 BA, 1914 Edwardian; 2784 sq.ft., 2 pkg, large deck. 19 DOM, 114% of LP, $718/sq.ft.

$1,995,000. Telegraph Hill on Francisco: 3-level, 3 BR/2.5 BA, Mediterranean-style, townhouse condo built in 1988; 2374 sq.ft., 3 terraces, bay and city views, $1971/month HOA dues, 2 pkg. 100% of LP, $840/sq.ft.

$1,950,000. Bernal Heights on Nevada: 7-room, 4 BR/3.5 BA, contemporary home; 2879 sq.ft., bay views, full floor master suite, solar heat, 2 pkg. 31 DOM, 93% of LP, $677/sq.ft.

$1,775,000. Financial District on Pacific: 1984, 2-level, 3 BR/3 BA condo at Golden Gateway Commons; 1850 sq.ft., 4 decks, downtown and Bay Bridge views, 1 pkg, $747/month HOA dues. 2 DOM, 100% of LP, $959/sq.ft.

$1,750,000. Lower Pacific Heights on Pine: 8-room, 2-level, 4 BR/3.5 BA, Victorian condo in 2 unit bldg; 2375 sq.ft., 1 pkg, $300/month HOA dues. 26 DOM, 100% of LP, $737/sq.ft.

$1,750,000. Pacific Heights on Green: 1988, 5-room, 2-level, 2 BR/2 BA, townhouse condo; 1560 sq.ft., large view deck, GG bridge and bay views, 1 pkg, $577/month HOA dues. 27 DOM, 97.5% of LP, $1122/sq.ft.

$1,740,000. Mt. Davidson Manor on Monterey: 1930, 7-room, detached, 4 BR/3 BA, Spanish-Med house; 2668 sq.ft., ocean views, 1 pkg. 20 DOM, 116% of LP, $652/sq.ft.

$1,700,000. Eureka Valley on Caselli: 1918, 3 BR/2 BA Edwardian; 1720 sq.ft., deck, south garden, 1 car pkg pad, plans for 1st floor expansion. 7 DOM, 122% of LP, $988/sq.ft.

$1,550,000. Cole Valley on Belvedere: 1907, upper unit, 2-level, 4BR/3 BA condo in 3-unit bldg; 2535 sq.ft., city and park views, 1 pkg, $300/month HOA dues. 30 DOM, 107% of LP, $611/sq.ft.

$1,515,000. South Beach on Brannan: 5-room, 2 BR/2 BA condo at The Brannan; 1602 sq.ft., city lights views, 1 pkg, 24-hour security, $977/month HOA dues. 14 DOM, 101% of LP, $946/sq.ft.

$1,505,000. Marina on Francisco: 3 BR/1.5 BA, full-floor condo built in 1923; 2 unit bldg, 1400 sq.ft., 1 pkg, $200/month HOA dues. 14 DOM, 116% of LP, $1075/sq.ft.

$1,500,000. Eureka Valley on Collingwood: 7-room, 2 BR/2 BA, contemporary house with no parking; 1850 sq.ft., downtown and bay views, deck, spa. 109% of LP, $810/sq.ft.

$1,500,000. Sherwood Forest on Casitas: 1952, 5 BR/4 BA, detached modern home; 4769 sq.ft. + basement, city and ocean views. 255 days on market, 75% of LP, $315/sq.ft.

$1,475,000. Inner Sunset on 5th: 1908, 4 BR/1.5 BA, Arts & Crafts Edwardian; 1864 sq.ft. + huge attic, deck, 1 pkg. 106% of LP, $791/sq.ft.

$1,275,000. Mission Dolores on Dorland: 6-room, top floor, 3 BR/1.25 BA, Edwardian condo with leased off-site parking; 1490 sq.ft., Liberty Hill views, shared yard, $660/month for HOA and pkg. 7 DOM, 116% of LP, $856/sq.ft.

$1,268,500. Inner Mission on Lexington: 2002, 6-room, top floor, 2-level, 3 BR/2.5 BA condo. 1589 sq.ft., Twin Peaks views, deck, 1 pkg, $319/month HOA dues. 15 DOM, 123% of LP, $798/sq.ft.

$1,265,000. Potrero Hill on Carolina. 1957, 7-room, 4 BR/2 BA, midcentury home; 1608 sq.ft., 1 pkg. 21 DOM, 101% of LP, $787/sq.ft.

$1,265,000. Haight Ashbury on Page: 1908, 6-room, top floor, 3 BR/1.75 BA condo in 2 unit bldg; private south deck, 1783 sq.ft., $150/month HOA. 18 DOM, 120% of LP, $709/sq.ft.

$1,260,000. Lone Mountain on Stanyan: 1937, 3 BR/1 BA, traditional house near Rossi Park; 1923 sq.ft., 2 pkg. 14 DOM, 110% of LP, $655/sq.ft.

$1,260,000. South Beach on 1st: 4-room, 2 BR/2 BA condo at The Metropolitan high-rise; panoramic views in 3 directions, 1166 sq.ft., large patio, 24-hour doorman, 1 pkg. 36 DOM, 101% of LP, $1081/sq.ft.

$1,251,000. Golden Gate Heights on 15th: 1946, 4 BR/3 BA, traditional house; 1781 sq.ft., bonus family room, ocean views, 2-tier patio, 2 pkg. 14 DOM, 126% of LP, $702/sq.ft.

$1,250,000. Central Richmond on 29th: 1936, 8-room, 4 BR/4 BA, center-patio, Spanish-Med home; 1705 sq.ft., 2 pkg. 21 DOM, 114% of LP, $733/sq.ft.

$1,235,000. SoMa on Stevenson: 2008-built, multi-level, 3 BR/3 BA, townhouse condo; 1679 sq.ft., 2 decks, 1 pkg, $402/month HOA dues. 25 DOM, 118% of LP, $736/sq.ft.

$950,000. Hayes Valley on Fillmore: 1981, 2 BR/2 BA condo flat in 3 unit bldg; 1500 sq.ft., 1 pkg, deck, $270/month HOA dues. 8 DOM, 119% of LP, $633/sq.ft.

$985,000. Duboce Triangle on 14th: 1907, 3 BR/2 BA, Victorian TIC flat in 3 unit bldg; 1529 sq.ft., 1 pkg, city lights view. 22 DOM, 109.5% of LP, $644/sq.ft.

$995,000. Lake Street on 2nd: 1946, 5-room, top floor, 2 BR/1 BA condo in 2 unit bldg; 1209 sq.ft., 1 pkg, $200/month HOA dues. 11 DOM, 117% of LP, $823/sq.ft.

$999,000. Yerba Buena on Folsom: 2009, 5-room, 2 BR/2 BA condo at Blu; 1230 sq.ft., den, 1 pkg, $715/month HOA dues. 23 DOM, 105% of LP, $812/sq.ft.

$1,000,000. Outer Richmond on Fulton: 1931, 7-room, 3 BR/2 BA, Marina-style house; 1950 sq.ft., 1 pkg. 30 DOM, 118% of LP, $513/sq.ft.

$1,000,000. Central Sunset on 32nd: 1939, 6-room, 3 BR/1.5 BA, center-patio house; 1815 sq.ft., 2 pkg. 21 DOM, 105% of LP, $551/sq.ft.

$1,000,000. Bernal Heights on Bonview cul de sac: 1958, 3-level, 2 BR/2 BA, contemporary house; 1700 sq.ft., deck, western views, 1 pkg. Sold off-market, $588/sq.ft.

$1,001,000. Nob Hill on Washington: 2006, 4-room, 2 BR/2 BA, contemporary flat; 978 sq.ft., 1 pkg, $485/month HOA dues. 8 DOM, 111% of LP, $1023/sq.ft.

$1,005,000. North of Panhandle (NoPa) on Hayes: 1989, 4-room, 2-level, 2 BR/2 BA, townhouse condo; 1620 sq.ft., 2 pkg, private deck, $605/month HOA dues. 41 DOM, 106% of LP, $620/sq.ft.

$1,015,000. Glen Park on Van Buren: 1913, detached, 2 BR/2 BA Edwardian with no parking; 1249 sq.ft., city and bay views, "gardener's paradise". 52 DOM, 107% of LP, $813/sq.ft.

$795,000. Crocker Amazon on Lowell: 1923, 6-room, 2 BR/1 BA house; 1820 sq.ft., sunroom, bonus rooms, probate sale, 2 pkg. 18 offers, 119% of LP, $437/sq.ft.

$799,000. Lower Pacific Heights on Baker: top floor, 2 BR/1 BA, Victorian condo in 2 unit bldg; 902 sq.ft. + undeveloped attic, 1 pkg, $200/month HOA dues. 40 DOM, 100% of LP, $886/sq.ft.

$800,000. Outer Sunset on 44th: 1931, 2 BR/1 BA, Spanish-Med house; 1200 sq.ft., 1 pkg, 2 bonus rooms and bath. 20 DOM, 125% of LP, $667/sq.ft. (not including bonus rooms).

$800,000. Miraloma Park on Portola: 1926, 6-room, 3 BR/1 BA, detached Tudor home; 1435 sq.ft., bonus attic room, 3 pkg. 6 DOM, 123% of LP, $557/sq.ft.

$800,000. Inner Mission on 21st: 1999, 1 BR/1.5 BA live-work loft condo; 1137 sq.ft., 1 pkg, $260/month HOA dues. 17 DOM, 114% of LP, $704/sq.ft.

$805,000. Outer Parkside on 46th: 1943, 7-room, 3 BR/2 BA house; 1432 sq.ft., 2 pkg. 7 DOM, 121% of LP, $562/sq.ft.

$806,000. Mission Terrace on Santa Rosa: 1925, 6-room, 2 BR/1 BA house; 1600 sq.ft., trust sale, bonus room, 2 pkg. 124% of LP, $504/sq.ft.

$810,000. Noe Valley on Fair Oaks: 1900, 5-room, lower level, 2 BR/1 BA flat in 2 unit condo bldg with leased parking offsite; 1184 sq.ft., $250/month HOA dues. 104% of LP, $684/sq.ft.

$810,000. Midtown Terrace on Dellbrook: 1956, 2 BR/1 BA, mid-century home; 937 sq.ft., 2 pkg. 20 DOM, 108% of LP, $864/sq.ft.

$635,000. Excelsior on Maynard: 1907, 3 BR/1 BA, Victorian cottage with no parking; 1100 sq.ft. + bonus room, seismic retrofit. 33 DOM, 116% of LP, $577/sq.ft.

$638,000. Silver Terrace on Silver: 1941, 5-room, 2 BR/1.5 BA house; 1075 sq.ft. + large bonus family room, 2 pkg. 31 DOM, 107% of LP, $593/sq.ft.

$649,000. Dogpatch on 23rd: 1 BR/1 BA live-work loft built in 2000; 1084 sq.ft., private patio, $502/month HOA dues, 1 pkg. 28 DOM, 100% of LP, $599/sq.ft.

$649,000. Pacific Heights on Washington: 2001, 1 BR/1 BA condo in high-rise Pacific Place; 745 sq.ft., Nob Hill views, 1 pkg, 24-hour security, tenant-occupied, $609/month HOA dues. 22 DOM, 100% of LP, $871/sq.ft.

$650,000. Central Richmond on 15th: lower level, Marina-style, 6-room, 2 BR/1 BA TIC flat in 2 unit bldg; 1350 sq.ft., 1 pkg, tenant occupied. 26 DOM, 108.5% of LP, $481/sq.ft.

$652,000. North of Panhandle (NoPa) on Broderick: 2007, 4-room, top floor, 1 BR/1 BA condo in mid-rise bldg; 671 sq.ft., 1 pkg, city lights view, $404/month HOA dues. 18 DOM, 109% of LP, $972/sq.ft.

$653,000. Parkside on Vicente: 1939, 4-room, 2 BR/1 BA, contemporary home; 837 sq.ft., 1 pkg. 29 DOM, 109% of LP, $780/sq.ft.

$655,000. Potrero Hill on Kansas: 2007, 4-room, 1 BR/1 BA condo at The Potrero; 804 sq.ft., downtown views, 1 pkg, $470/month HOA dues. 28 DOM, 109% of LP, $815/sq.ft.

$665,000. South Beach on King: 2007, 3-room, 1 BR/1 BA condo in high-rise; 681 sq.ft., city views, 1 pkg, $561/month HOA dues. 28 DOM, 102% of LP, $977/sq.ft.

$657,000. Sunnyside on Judson: 5-room, 2 BR/2 BA, split-level contemporary; 1226 sq.ft., 1 pkg. 31 DOM, 116% of LP, $536/sq.ft.

$485,000. Western Addition on Eddy: 1992, 2 BR/2 BA condo in low-rise bldg.; 812 sq.ft., 1 pkg, $411/month HOA dues. 124% of LP, $610/sq.ft.

$500,000. Oceanview on Minerva: 1941, 5-room, 2 BR/1 BA, contemporary house; 1030 sq.ft., sunroom, 1 pkg. 22 DOM, 116% of LP, $485/sq.ft.

$500,000. Portola on Woolsey: 1948, 5-room, 2 BR/1 BA, tunnel-entrance "fixer" house; 1250 sq.ft., 2 pkg. 17 DOM, 91% of LP, $400/sq.ft.

$500,000. Twin Peaks on Gardenside: 1975, top floor, 3-room, 1 BR/1 BA condo; 180 degree downtown and bay views, 693 sq.ft., 1 pkg, $342/month HOA dues. 117% of LP, $722/sq.ft.

$500,000. Civic Center on Van Ness: top floor, 1 BR/1 BA condo at Opera Plaza; 682 sq.ft., 1 pkg, 24-hour security, deck, $862/month for HOA dues and parking. 13 DOM, 114% of LP, $733/sq.ft.

$510,000. Bayview on Shafter: 1951, 8-room, 2 BR/1 BA home with legal 2 BR unit; 1695 sq.ft., 1 pkg. 24 DOM, 106% of LP, $301/sq.ft.

$340,000. Visitacion Valley on Wilde: 1922, 1 BR/1 BA house; 700 sq.ft., 3 pkg. 20 DOM, 110% of LP, $486/sq.ft.

$368,000. Bayview on Rebecca Lane: 1992, 2 BR/2 BA house; bay views, deck, 1237 sq.ft., 1 pkg. 29 DOM, 108% of LP, $297/sq.ft.

$378,900. Downtown on Frank Norris Place: 1 BR/1 BA condo without parking; 522 sq.ft., south and east views, must be 55+ years old, $367/month HOA dues. 25 DOM, 100% of LP, $726/sq.ft.

$380,000. Downtown on O'Farrell: top floor, studio condo at The Hamilton; 480 sq.ft., huge south and east views, tenant occupied, $574/month HOA dues + $250/month for parking. 34 DOM, 100% of LP, $792/sq.ft.

$385,000. Diamond Heights on Red Rock Way: 1972, studio condo with 1 car pkg; 592 sq.ft., $407/month HOA dues. 129% of LP, $650/sq.ft.

Dollar per Square Foot ($/sq.ft.) is based upon the home's interior living space and should not include garages, unfinished attics and basements, rooms built without permit, outdoor space, patios and decks-though all these can still add value. These figures are usually derived from appraisals or tax records, but are sometimes measured in different ways, unreliable or unreported altogether. All things being equal, a house will sell for a higher dollar per square foot than a condo (due to land value), a condo higher than a TIC (quality of title), and a TIC higher than a multi-unit building (quality of use). All things being equal, a smaller home will sell for a lower sales price, but a higher dollar per square foot than a larger one. However, with our enormous variety in property types, all things are rarely equal in San Francisco real estate. There are often huge variations of value within a single neighborhood: the specific location, property condition, architectural style and curb appeal, amenities, parking, views, lot size & outdoor space all affect dollar per square foot values. Typically, the highest figures in San Francisco are achieved by penthouse condos with utterly spectacular views in prestige, doorman buildings, and by mansions in the absolute best locations of the most prestigious neighborhoods-more often than not, they too will have great views.

All information is from sources deemed reliable, but may contain errors and is subject to revision. © 2013 Paragon Real Estate Group

Luxury Home Snapshot

Luxury Home Market Snapshot

In April of 2012, the percentage of total SF home sales selling in this price range was 10%. In April of 2013, that percentage made a huge jump to 18% of sales.

Broker Metrics charts can be a little hard to decipher: for greater legibility, you may wish to adjust your screen view to Zoom 125%.

Luxury Homes for Sale: Unlike the general inventory of home listings (which is much lower year over year), the number of SF homes listed and actively for sale for $1.5m and above in April -- at 237 listings -- though well below last autumn’s levels, was about 10% higher than it was last year, and climbing. Part of this is simply the appreciation of home prices we've seen over the past year: if prices are up 20% or more, then a fair number of houses that were listing and selling under $1.5m twelve months ago, will now be over that price threshold.

300 Ivy is Ready to Sell!

Hayes Valley's newest development, 300 Ivy, is opening it's Sales Center this weekend. There are 63 brand new units comprised of Studios, 1bds, 2bds and townhomes that you are sure to love. View Floor Plans

Don't forget, with new construction projects, if you go to the Sales Center without your Realtor, you will not be allowed to use them during your purchase. If you want to go take a look, let me know and I'll schedule an appointment for us to walk-through together. Make sure you have the buyer representation you deserve!

May 2013 Market Snapshot

The San Francisco Homes Market

May 2013 Snapshot

April's market was basically more of the same of what we've been seeing for the last 12-16 months in San Francisco. Virtually all of our statistics are at historic or near-historic readings: number of homes for sale way down, months supply of inventory way down, percentage of listings accepting offers way up, days on market way down -- all leading to overall house and condo median and average prices climbing to perhaps the highest points they've ever reached. We will add the usual caveat that no one or two months of data should be considered definitive until confirmed over the longer term: though there is no doubt that San Francisco is experiencing a red hot market, prices can fluctuate for various reasons, including seasonality.

We will have to wait and see if the current heights reached in home prices are the new baseline, a springtime blip, or a way station to even higher real estate values.

Contact me anytime for assistance, information and resources regarding living in San Francisco.

| Paragon Real Estate Group (415)738-7000 | (415)565-0500 | www.paragon-re.com |

|

SOMA/South Beach Market Update

SoMa - South Beach - Yerba Buena - Mission Bay

Sales by Price Range

The greatest number of condo sales in these neighborhoods is in the $500,000 to $750,000 price range, however many sell for less (sometimes distressed property sales) and many sell for far more. Indeed, some of the most expensive condos in the city, usually with staggering views and selling at dollar per square foot figures above $1000, are found here in distinctive buildings among the most beautiful in the world. One condo in this area sold for $28 million in 2011. In 2012, the largest sale through MLS was $7,850,000 for a unit at the Millennium.

Longer-Term Trends for South Beach & SoMa Values The four following charts and tables track average sales price and average dollar per square foot for non-distress condo sales by year since 1995, specifically for the South Beach/ Yerba Buena and SoMa neighborhoods. Remember that average sales price is different from median sales price (which is used more often), but is just another way to look at long-term market trends. Distress sales (bank and short sales) were excluded from this analysis to provide an apples to apples comparison over time. The market recovery in 2012 can be seen very clearly -- and we're seeing further acceleration in 2013.

Condo Sales $1,000,000 & Above The sales of higher-end condos surged in 2012. There is huge demand for the best condos in the best buildings. The drop in the first quarter is typical due to holiday season dynamics for higher end buyers and sellers.

Condos for Sale

The inventory of condos listed for sale through MLS is far below that of previous years and is not currently anywhere close to being adequate to meet market demand.

Average Days on Market

As a market gets hotter, the average amount of time it takes for a new listing to go into contract usually falls, and that is exactly what we've been seeing in these neighborhoods and indeed all over San Francisco.

Months Supply of Inventory (MSI) MSI is the lowest it has been here in years, if not ever. The lower the MSI, the stronger the demand as compared to the supply of homes for sale. MSI readings this low -- below 2 months -- would typically be considered indicative of a very strong "Seller's Market."

Price Reductions, Sales Price to List Price Percentage, and Days on Market

Another chart illustrating the heat of the current market. The vast majority of sales are accepting offers quickly to sell on average for over the asking price -- competitive bidding is common.

Distress Condo Listings & Sales in the Greater SoMa Area

Because so many large developments were built here in the last 15 years, this area had more distressed condo sales (bank-owned property sales and short sales) than any other area of the city. However, the number of distressed listings and sales has been declining rapidly as the market has turned around. It is now well on its way to disappearing altogether.

Median Sales Price Trends for 2-Bedroom Condos in Selected SF Neighborhoods A comparison of median price trends for 2BR condos in 5 of the city’s neighborhoods. All have seen substantial jumps in median sales price, but perhaps none more than South Beach/ Yerba Buena neighborhoods. We will update this chart as soon as we have enough months of sales data to create meaningful statistics.

The New-Development Condo Market The vast majority of new-condo construction over the past 15 years has been in this greater area. The 2008 financial crisis caused new condo construction to crash in SF, which led to large declines in new-condo listings and sales. Even though new construction is now recovering in a big way, this large reduction in new-condo inventory for sale has had significant ramifications for the supply and demand dynamic. The new inventory of newly built condos will be at least a year to two years before arriving in large quantities.

2013 1st Quarter Market Update

A Hot San Francisco Market Gets Hotter

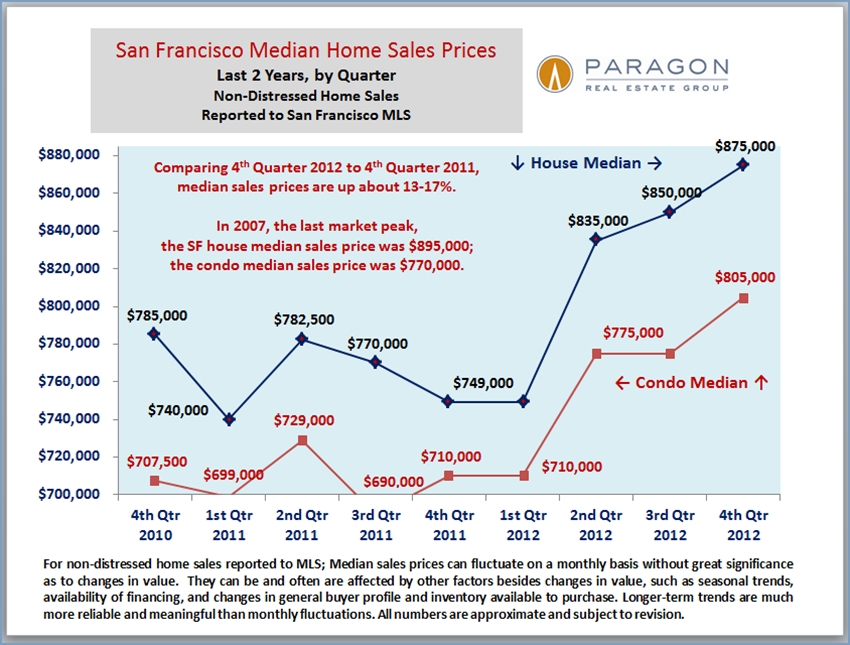

In 2012, the market turned with a vengeance and grew very hot very quickly. Now in 2013 it has grown even hotter. Recent deal-making stories almost make the seemingly crazy, multiple-offer tales of last year appear sedate. The supply of listings is drastically low against buyer demand, and the pace of price appreciation looks to be accelerating. Some city neighborhoods appear to be surpassing the previous peak values reached in 2007-2008. As seen below, the first quarter’s numbers reveal a big increase in home values year over year; the month of March alone saw a particularly big jump of almost 9% above February’s median price.

March sales prices reflect the heat of the market 4-8 weeks earlier, when the offers were actually negotiated. Much of the first quarter’s sales data reflects offers negotiated in late 2012. In a rapidly changing market, we’re always looking in the rearview mirror.

How Does Supply & Demand Affect San Francisco Home Prices?

The past 18 months give a text book example of how the supply and demand dynamic affects home values. Months Supply of Inventory (MSI) measures the strength of buyer demand against the available inventory of homes to purchase: the lower the MSI, the hotter the market. The hotter the market, the greater the upward pressure on prices.

Median Home Sales Prices by Month

One can see the acceleration in monthly median sales price in the chart above. March’s was almost 9% above February’s and about 30% above March 2012.

And this chart below breaks out the median sales prices of houses and condos separately by quarter, but looks at non-distressed property sales only. Distressed property sales, by their nature and because they’ve always clustered at the lower price ranges, lower median sales significantly – though that entire market segment is in rapid decline.

The Percentage of Listings Selling Over & Under List Price

As the market has strengthened, the percentage of SF homes selling for over -- and sometimes far over -- list price, has soared to almost unbelievable levels. In the last 2 months, 30% of SF house sales have sold for 15% or more above asking price.

Inventory of Listings Available to Purchase

This chart above shows the huge decline in inventory since the market turnaround began. Typically, we see a surge in early spring. Not this year, at least not so far.

Percentage of Listings Accepting Offers

Percentage of Listings Accepting Offers is another excellent indicator of demand vs. supply, and it is now at the highest levels in memory for virtually all property types: houses, condos, TICs and the luxury home segment.

Average Days on Market

Generally speaking, the hotter the market, the faster listings go into contract and that is what we are indeed seeing now.

Months Supply of Inventory

This chart above breaks out the details of the huge decline in Months Supply of Inventory since the market started to recover.

----------------------------------------------------------------------------

What Costs How Much Where-March 2013 SF Market Update

What Costs How Much Where in San Francisco

San Francisco Home Values by Neighborhood & Bedroom Count

The March 2013 Paragon Market Report

We've just completed our semiannual review of SF house and condo values by average and median prices, average size and average dollar per square foot for sales occurring September 1, 2012 - February 28, 2013, as reported to MLS.

The maps contain median sales price data only, while the tables include the full range of value statistics. (The tables are easier to read, but they're not as colorful.) If a price is followed by a "k" it references thousands of dollars; if followed by an "m", it signifies millions. Remember that medians and averages are very general statistics.

Further down in the newsletter are charts tracking supply and demand dynamics and price appreciation trends for the city's residential real estate market. Statistical definitions can be found at the very bottom. For the smaller images, you'll need to click-to-expand them to really make them decipherable.

click for larger image

|

4-Bedroom House Values This is the table for 4-bedroom house sales over the past 6 months. This link goes to the full analysis by property type, neighborhood and bedroom count. Neighborhood, Property Type, Bedrooms |

click for larger image

|

2-Bedroom Condo Median Price Map A map of median sales prices for 2-bedroom condos around the city. The table in the full analysis provides further statistical measures. Full Analysis |

click for larger image

|

Trends in Inventory & Sales Volume Sometimes there's nothing like a chart to depict trends. Here one can clearly see the drastic decline in inventory. And this link goes to a chart on Months Supply of Inventory, another statistic of supply and demand: Months Supply of Inventory |

click for larger image

|

New Listings Coming on Market The quantity of new listings ebbs and flows by season, however even accounting for seasonality, the number of new listings coming on market is much lower than usual. And this link shows the increasing demand since the market recovery really got underway in 2012: Percentage of Listings Accepting Offers |

click for larger image

|

Median Price Trends by Month Monthly price data often fluctuates due to a variety factors. For example, median and average prices almost always drop in January since the higher end of the market usually checks out for the holidays: Values haven't changed; the demographic of buyers and available inventory changed. However, the clear upward trajectory of prices over the past year is clear in both median and average sales prices. Average Price Trends |

The MEDIAN SALES PRICE is that price at which half the properties sold for more and half for less. If there were 3 sales, at $1, $2 and $10, the median price would be $2. If there were 4 sales at $2, $2, $5 and $10, the median would be $3.50. Median sales price may be affected by seasonal trends, and by changes in inventory or buying trends, as well as by changes in value.

AVERAGE DOLLAR PER SQUARE FOOT is based upon the home's interior living space and does not include garages, storage, unfinished attics and basements; rooms and apartments built without permit; decks, patios or yards. These figures are typically derived from appraisals or tax records, but can be unreliable, measured in different ways, or unreported altogether: thus consider square footage and $/sq.ft. figures to be very general approximations. Generally speaking, about 60-80% of listings report square footage, and dollar per square foot statistics are based solely on those listings. All things being equal, a house will have a higher dollar per square foot than a condo (because of land value), a condo will have a higher $/sq.ft. than a TIC (quality of title), and a TIC's will be higher than a multi-unit building's (quality of use). All things being equal, a smaller home will have a higher $/sq.ft. than a larger one. The highest dollar per square foot values in San Francisco are typically found in upper floor condos in prestige buildings with utterly spectacular views.

The AVERAGE SIZE of homes of the same bedroom count may vary widely by neighborhood: for example, the average size of a 4-bedroom house in Pacific Heights is much larger than one in Noe Valley; and the average of a Marina 2-bedroom condo is larger than one in South Beach. Besides the affluence factor, the era and style of construction often play large roles in these disparities.

Some neighborhoods are well known for having additional ROOMS BUILT WITHOUT PERMIT, such as the classic 1940's Sunset house with "bedrooms" and baths built out behind the garage. These additions often add value, but being unpermitted are not reflected in $/sq.ft. figures.

Many aspects of value cannot be adequately reflected in general statistics: curb appeal, age, condition, views, amenities, outdoor space, "bonus" rooms, parking, quality of location within the neighborhood, and so forth. Thus, how these statistics apply to any particular home is unknown.

All information herein is derived from sources deemed reliable, but may contain errors and omissions, and is subject to revision. © Paragon Real Estate Group, March 2013

|

SOMA/South Beach Market Update

More condos sell in San Francisco's South of Market (SoMa), South Beach, Yerba Buena and Mission Bay neighborhoods than anyplace else in the city: This is where by far the greatest number of new condos has been built in the last 20 years. The market here heated up very rapidly in 2012, especially as the number of brand new condos on the market has dwindled (contributing to the severe inventory crunch). This area is one of the world centers for high-tech and bio-tech businesses and homebuyers, and the ferocious demand competing for the very limited inventory have caused prices to jump dramatically.

Luxury condos here, in high prestige buildings, typically with spectacular views, sell for among the highest dollar per square foot values in the city. The largest sale reported to MLS in 2012 was $7,850,000 for a unit at the Millennium.

**************************************

Sales by Price Range

Long-Term Trends in Values

The following charts track average sales price and average dollar per square foot for non-distressed condo sales by year since 1995, specifically for the South Beach/Yerba Buena and SoMa neighborhoods. Remember that average sales price is different from median sales price (which is used more often), but is just another way to look at long-term market trends.

Here, we've limited the analyses to sales under $1,800,000: though this area has a large luxury component, the very high-end sales generally distort the averages for the vast majority of sales.

Sales Over, Under and At List Price

As the market gets hotter, the percentage of listings selling for over asking price increases.

Median Sales Price Trends for 2-Bedroom Condos

A comparison of Median Price trends for 2-BR condos in 5 of the city's neighborhoods. All 5 have been showing median price appreciation, but none more so than the South Beach and Yerba Buena neighborhoods.

Number of Listings Sold

Very strong unit sales numbers in recent quarters and they would have been significantly higher if there were more listings available to buy. Distressed condo sales are rapidly declining as the market recovery has gained momentum.

Percentage of Listings Accepting Offers

An excellent statistic for measuring buyer demand against supply of inventory. The percentage is now at the highest point in memory.

Condos for Sale

The inventory of condos listed for sale through MLS is far below that of previous years and is seriously inadequate to meet market demand.

The New-Development Condo Market

The vast majority of new-condo construction over the past 15 years has been in this greater area: it's been estimated that over 10,000 were built here in the first 10 years of the century. The 2008 financial crisis caused new condo construction to crash in SF, which led to large declines in new-condo listings and sales. Now, new construction is recovering in a big way -- many big new projects are planned by some very well-known developers -- but it will probably take about 2 years, more or less, before we see a large quantity of newly built condos coming on the market.

Months Supply of Inventory (MSI)

The lower the MSI, the stronger the demand as compared to the supply of homes for sale. MSI readings this low -- below 2 months - is considered to be indicative of a strong "Seller's Market."

Condo Sales $1,000,000 & Above

The number of condos selling for $1m and above is at its highest point in years: Sales increased in the 4th quarter even as inventory fell. Demand for higher-end condos in the best buildings is quite competitive now.

Distressed Condo Listings & Sales in the Greater SoMa Area

Because so many large developments were built here in the last 15 years, this area had more distressed condo sales (bank-owned property sales and short sales) than any other area of the city. However, the number of distressed listings and sales has been rapidly declining with the market turnaround and looks to disappear completely in the near future.

District 5 Update- Noe Valley, Eureka Valley, Cole Valley, Glen Park

Noe Valley-Eureka Valley-Cole Valley District

District 5 is one of the more homogeneous districts in San Francisco in terms of property values, but still any analysis of an area with so many properties of different type, location, condition and quality can only be a very general overview.

District 5 soared in value between 1996 and 2008 and was one of the last districts to peak in value before the financial markets meltdown in September 2008. Values then fell 15% to 20% very quickly and then stabilized in 2009 and 2010. With the surge in high-tech buyers in 2011 (among other economic factors), many of whom wish to be close to highways to the peninsula -- and love the lifestyle and ambiance of District 5 neighborhoods and its commercial districts -- activity in this district picked up dramatically.

In 2012, the competition between qualified, motivated buyers here became ferocious: inventory is very low, certainly not enough to satisfy buyer demand, and many of the listings are selling very quickly in multiple-offer, competitive-bidding situations. This is exerting considerable upward pressure on prices.

If you adjust your screen view to a 125% zoom, the charts will be that much easier to read. On Windows systems, pressing the Control and + keys simultaneously should do this quickly.

Home Sales by Price Range A snapshot of number of sales by price segment in 2012.

Average Sales Prices & Average Dollar per Square Foot The two statistics of value in the charts following -- average sales price and average dollar per square foot -- can change depending on a number of market factors, but the general price trend over the past year or so is clearly upward. High demand plus low supply equals higher prices. When neighborhoods are grouped together below, it is because they generally share similar market values in particular property types. Annual statistics, because of the much greater amount of data, are typically more reliable than (fluctuating) quarterly or monthly stats, however when a market is changing quickly, as it has in 2012, annual data will minimize market changes (which is why the charts show statistics from the latter part of the past year).

Luxury Home Sales Higher end home sales in the Noe Valley, Eureka Valley, Cole Valley and associated neighborhoods of Realtor District 5 dramatically surged in 2012. Though prices are still significantly lower than in the old-prestige, northern neighborhoods such as Pacific and Presidio Heights, this area is playing a greater and greater role in luxury home segment. High-tech buyers are definitely playing a major role in this dynamic.

Percentage of Listings Accepting Offers

An excellent statistical snapshot of supply and demand. As the market heated up, the percentage started climbing higher in 2011 and is now at its highest level in memory.

Price Reductions, Sales Price to List Price Percentage, and Days on Market Right now, the great majority of the homes that sell in District 5 now accept offers quickly before any price reductions are necessary and on average go well over asking price. However, those listings that go through one or more price reductions take much longer to sell and sell at a large discount to original list price. No matter what the market, proper pricing is a vital issue in the sale of real estate.

Homes for Sale on the Last Day of the Month

The drastically low inventory of homes available to purchase in this area is clearly illustrated in this chart.

Months Supply of Inventory (MSI) MSI is at an extremely low level of inventory for houses and condos, a reading that would be considered indicative of a very strong "Seller's Market." Indeed anything under 3-4 months is usually considered a Seller's Market.

Average Days on Market (DOM) Before Acceptance of Offer

These figures can fluctuate without great meaningfulness -- a few listings that sell after being on the market for a long time can have a large impact on the average, even when new listings are selling very quickly -- but the trend can be interesting. Right now, many listings are accepting offers within 7-14 days of going on market.

February 2012 Market Report Full-The Crunch in SF Real Estate

The Crunch in San Francisco's Real Estate Market

Over the last 13 months, for a variety of compelling economic reasons, home-buyer demand in San Francisco has continued to grow ever stronger, while the inventory of homes available to purchase has only become tighter. This is the classic supply and demand dynamic -- increased competition for a scarce commodity -- that leads to increasing prices. Our inventory crunch, at least so far in 2013, is not easing. This situation is advantageous to sellers, and difficult and aggravating for buyers (and their agents): the time, effort, emotional energy and money that it takes to find and buy a home have all been increasing.

However, if buyers can summon the patience and endurance to see the process through, they might take some solace in the last 2 real estate recoveries, in the eighties and nineties. As can be seen on charts further down, it's not unusual for repressed buyer demand to explode after a long down market, creating the same rapid appreciation situation we are experiencing now. But even with increasing competition and rising prices, those who purchased in the first few years of the past 2 turnarounds ended up doing very well with their investments. We don't know if this recovery will continue to follow the same trend lines as past market cycles, but it has thus far.

Below are analyses that look at both short-term and long-term trends from a variety of angles.

No, of course not: not all listings are selling for over list price. Some homes still go through price reductions and some don't sell at all, but it is true that a large percentage of SF listings is now selling for over asking price and sometimes far over. This is especially the case with houses, where 1 in 4 sold in the past 2 months went 10% or more over the list price. (Note: Homes selling for within a quarter percent of the list price were considered to have sold AT asking price.) And this link shows the dramatic increase in median home prices in 2012: Median House & Condo Prices

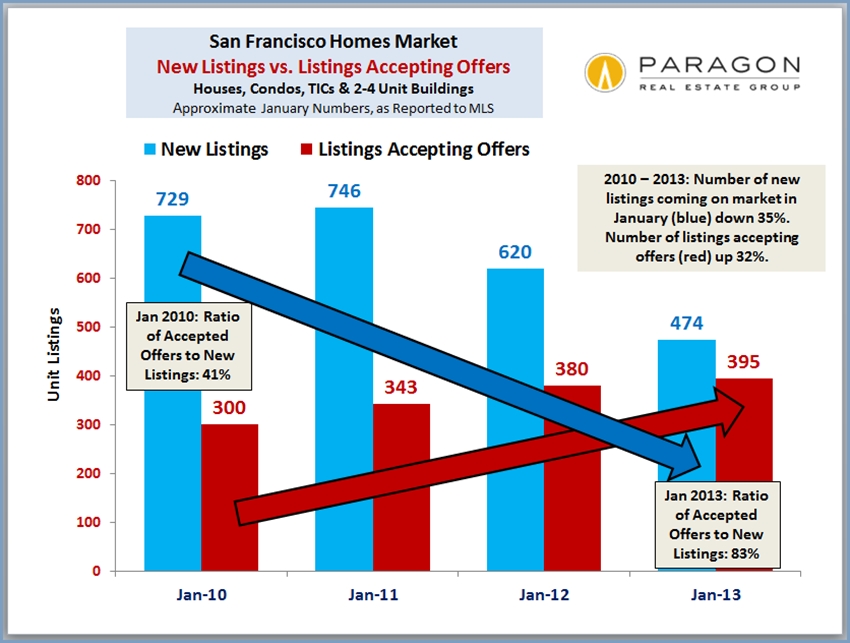

There are two issues behind the current low inventory crunch: firstly, there's the simple matter of fewer listings coming on market, and secondly, that the listings that do arrive are being snatched up very quickly. This chart compares the influx of inventory and buyer demand in January of the last 4 years. Currently, on any given day, the choice of listings available to purchase is far below that of previous years -- which fuels fierce competition between buyers. This link illustrates that fact and the overall decline in listings for sale: Listings for Sale

Even in a hot market, not every listing sells: some listings viewed as overpriced end up expiring or being withdrawn. However, the ratio of expired and withdrawn listings to sales declines significantly in a strong market, which is what happened last year. Typically, the fourth quarter is marked by a very high rate of expired and withdrawn listings due to the holiday season and end of the year, but in the last quarter of 2012, buyers continued to aggressively snap up listings. And this link goes to a days-on-market chart illustrating the increasing speed with which buyers are snapping up listings: Average Days on Market

This Case-Shiller chart for the 5-county SF Metro Area begins with the recovery following the market recession/ doldrums of 1991 - 1995. The market of 1996 and 1997 had basically the same dynamic of repressed demand exploding alongside a recovering economy that we're experiencing today. (All chart numbers reflect a percentage of the home values in January 2000.) There followed a 100% increase in values over the next 5 years, even before the inflation of the big bubble of 2004-2008. Buyers who bought in the mid-late nineties ended up doing quite well. This link shows the same dynamic in the transition from the late seventies/ early eighties recession to the mid-eighties rebound. Those buying in the early years of that recovery also did pretty well, even factoring in the following recession and market correction: Market Recovery in the 1980's

The chart and the one in the following link are two classic measures of supply and demand. The lower the months supply of inventory and the higher the percentage of listings accepting offers, the stronger the demand when compared to the supply of homes available to purchase. Percentage of Listings Accepting Offers

This analysis (just 1 part of a full report) compares buying a 2-bedroom SF home at the current median price of $775,000 to renting a 2-BR at the current average asking rent of $3800. It illustrates how buying can make excellent financial sense after tax benefits and principal pay-down are factored in, much less building substantial home equity over time. In this analysis, the "net" house payment comes out well below the rent. However, these scenarios depend on many assumptions such as interest, appreciation, inflation and income-tax rates. It depends on the rent one is paying and having the 20% down payment and closing cost monies available. Still, there's no doubt that with current interest rates and rents, the equation is much more favorable to buying than it has been for a very long time. Feel free to perform your own analyses using our Rent vs. Buy calculator, which can be accessed using this link. After putting in your numbers, be sure to click on Calculate and View Report: Calculators

Perspective on 3 SF Real Estate Market Recoveries

Perspective on 3 Recoveries

This Case-Shiller chart for the 5-county SF Metro Area begins with the recovery following the market recession/ doldrums of 1991 - 1995. The market of 1996 and 1997 had basically the same dynamic of repressed demand exploding alongside a recovering economy that we're experiencing today. (All chart numbers reflect a percentage of the home values in January 2000.) There followed a 100% increase in values over the next 5 years, even before the inflation of the big bubble of 2004-2008. Buyers who bought in the mid-late nineties ended up doing quite well. This link shows the same dynamic in the transition from the late seventies/ early eighties recession to the mid-eighties rebound.

Those buying in the early years of that recovery also did pretty well, even factoring in the following recession and market correction:

Interested in learning more about San Francisco real estate?

Simone Koga | Paragon Real Estate Group

1400 Van Ness Ave. | San Francisco, CA 94109

415.706.1586 | Simone@SimoneKoga.com

DRE#01897985

Ratio of Expired Listings to Sold Listings

Ratio of Expired Listings to Sold Listings

Even in a hot market, not every listing sells: some listings viewed as overpriced end up expiring or being withdrawn. However, the ratio of expired and withdrawn listings to sales declines significantly in a strong market, which is what happened last year. Typically, the fourth quarter is marked by a very high rate of expired and withdrawn listings due to the holiday season and end of the year, but in the last quarter of 2012, buyers continued to aggressively snap up listings.

And this chart goes to a days-on-market chart illustrating the increasing speed with which buyers are snapping up listings:

Interested in learning more about San Francisco real estate?

Simone Koga | Paragon Real Estate Group

1400 Van Ness Ave. | San Francisco, CA 94109

415.706.1586 | Simone@SimoneKoga.com

DRE#01897985

The Crunch in San Francisco's Real Estate Market-New Listings Accepting Offers

New Listings vs. Accepted Offers

There are two issues behind the current low inventory crunch: firstly, there's the simple matter of fewer listings coming on market, and secondly, that the listings that do arrive are being snatched up very quickly. This chart compares the influx of inventory and buyer demand in January of the last 4 years.

Currently, on any given day, the choice of listings available to purchase is far below that of previous years -- which fuels fierce competition between buyers. This chart illustrates that fact and the overall decline in listings for sale:

Interested in learning more about San Francisco real estate?

Simone Koga | Paragon Real Estate Group

1400 Van Ness Ave. | San Francisco, CA 94109

415.706.1586 | Simone@SimoneKoga.com

DRE#01897985

The Crunch in San Francisco's Real Estate Market-Over and Under Asking

Is Everything Selling Over the Asking Price?

No, of course not: not all listings are selling for over list price. Some homes still go through price reductions and some don't sell at all, but it is true that a large percentage of SF listings is now selling for over asking price and sometimes far over. This is especially the case with houses, where 1 in 4 sold in the past 2 months went 10% or more over the list price. (Note: Homes selling for within a quarter percent of the list price were considered to have sold AT asking price.)

The chart below shows the dramatic increase in median home prices in 2012.

Interested in learning more about San Francisco real estate?

Simone Koga | Paragon Real Estate Group

1400 Van Ness Ave. | San Francisco, CA 94109

415.706.1586 | Simone@SimoneKoga.com

DRE#01897985

San Francisco Event Schedule 2013

Check out all the great events San Francisco has to offer in 2013