San Francisco Real Estate

What You Get for How Much Where

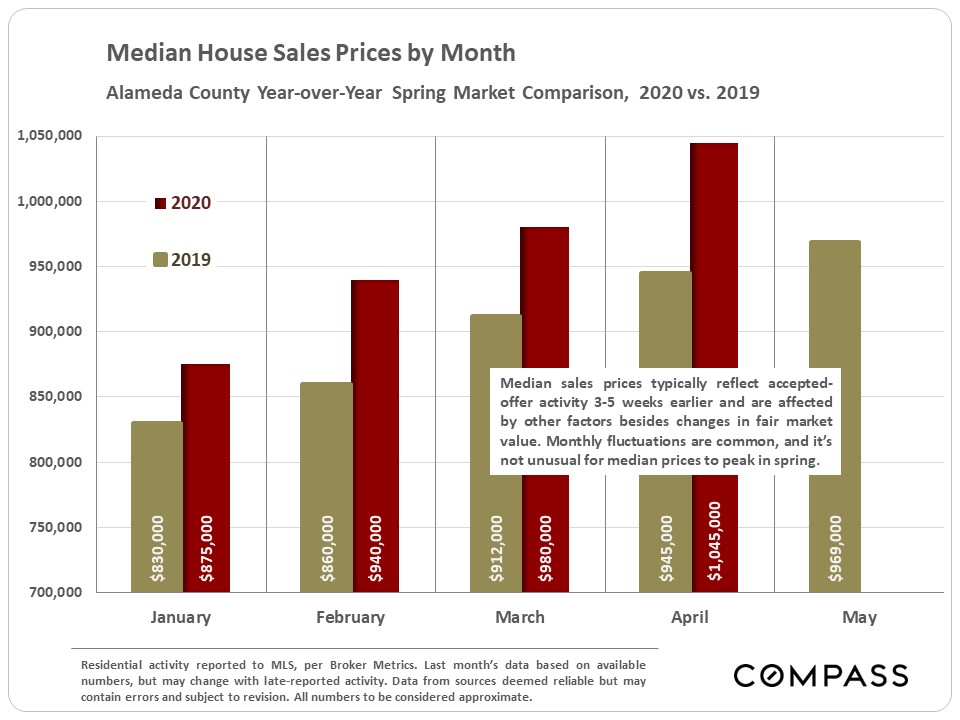

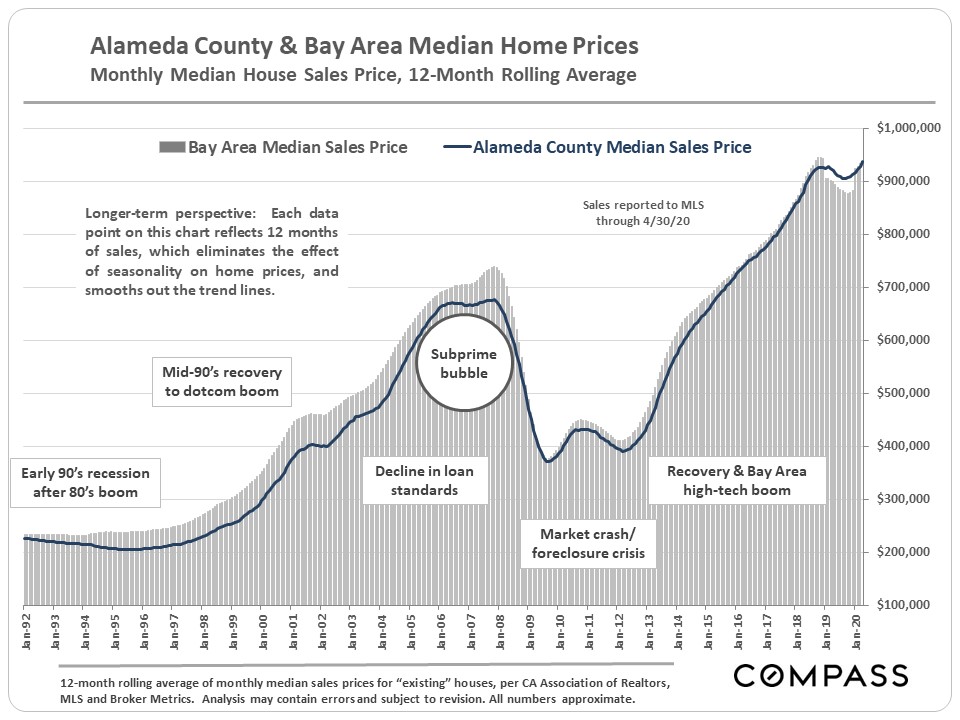

The exploding buyer demand and extraordinarily low inventory that have been the case in San Francisco since 2012 began are now showing up in broadly higher sales prices. Monthly statistics for a wide, varied market area (such as the city) should always be treated warily: they can be affected by a variety of factors, and longer-term trends are much more reliable. Still, April's median sales price for SF houses and condos jumped about 10% above March's and is now the highest in 2 years. The ferociousness of the current supply and demand dynamic is encapsulated in the large percentage of home listings across the city now receiving multiple offers almost immediately upon coming on market; some new listings have been generating literally dozens of bids. If sustained, there is no way such market conditions won't result in higher home values.

Sales prices reflect the market 4 to 8 weeks in the past, i.e. that time at which the accepted offers were actually negotiated, thus April's median sales price mostly reflects the market in February and March.

Below are 3 mapped analyses of recent SF home sales through the 1st quarter of 2012 by median price and average dollar per square foot. These provide an overview of comparative prices and values in the different areas of the city. They will not reflect any market-value changes showing up in April.

Following the maps is a sampling of specific 2012 San Francisco home sales.

Below is a random sampling of 2012 city home sales closing before April 30th. The short descriptions can only give a general sense of the location, appeal, quality, condition and amenities of each property, and the sales listed are not necessarily representative of typical values for the neighborhood and property type. With real estate, the devil is always in the details.

$11,000,000. Pacific Heights on Broadway: 1904, 7 bedroom, 6 bath, Gold Coast mansion; 9744 square feet, $1129/sq.ft., spectacular views from almost every room, 120-seat home theater, 4 car parking. Sold off market.

$10,000,000. Presidio Heights on Washington: 1910, 8 BR, 7 BA, 4-story mansion; GG bridge, bay or Presidio views from almost every room, but "home is in need of work", 3 car pkg. Original asking price of $15,000,000; 97 days on market.

$7,000,000. Alamo Square on Fulton: 1904, 13 BR, 14 BA "Archbishop's Mansion"; 20,000 sq.ft., $350/sq.ft., park and city views, 6-10 car parking, elevator. Original list price of $7,950,000; 164 days on market.

$4,980,000. Russian Hill on Green: 1928, 3 BR, 4.5 BA, full-floor co-op; almost 360 degree views, doorman building, 2 car pkg, $3200/month HOA dues. Original list price of $5,750,000; 98 days on market.

$4,795,000. Cow Hollow on Union: 5 BR, 4 BA house; 3962 sq.ft., $1210/sq.ft., large lot, pent-level with views, large south yard, 2 car pkg. Sold for 2% over asking price; 15 days on market.

$4,650,000. Telegraph Hill on Montgomery: 5-level, 2-condo building (4400 sq.ft. main residence; 1021 sq.ft. lower residence); $858/sq.ft., stunning views, 3 terraces, 3 pkg. Original list price of $7,000,000; 258 days on market.

$3,800,000. Yerba Buena on Minna: 3 BR, 3.5 BA, St. Regis condo; 2573 sq.ft., $1477/sq.ft., spectacular views, doorman building, valet pkg, leased pkg, $2569/month HOA dues. 4% below asking price; 101 days on market.

$3,400,000. Noe Valley on Fair Oaks: 1908, 5 BR, 4.5 BA Edwardian; 4126 sq.ft., $824/sq.ft., decks, garden, double lot, 2 car pkg. 100% of asking price; 8 days on market.

$3,200,000. St. Francis Wood on Santa Clara: 1929, 4 BR, 5.5 BA, Spanish-Mediterranean house; 5707 sq.ft., $562/sq.ft., double lot, heated pool, 2 pkg. 8% below original price; 73 days on market.

$2,995,000. Dolores Heights on Cumberland cul de sac: 1916, 3 BR, 2.5 BA, Arts & Crafts Edwardian house; 2500 sq.ft., $1198/sq.ft., "breathtaking city and bay views", 1 pkg. 100% of asking price; 10 days on market.

$2,875,000: Cole Valley on Cole: 1905, 12-room, 4 BR, 3.5 BA Edwardian home; 2850 sq.ft., $1009/sq.ft., 2 pkg. 1% over asking price; 25 days on market.

$2,850,000: Marina on Magnolia: year 2000, 5 BR, 4.5 BA, contemporary house; 3400 sq.ft., $838/sq.ft., water views, studio, roof deck, 2 pkg. 5% below original price.

$2,725,000. Lake Street on 25th Avenue: 1909, Thomas Churchill 4 BR, 3.5 BA Edwardian; 3700 sq.ft., $736/sq.ft., overlooking GG Bridge & Marin Headlands, plans for garage. 2% below asking price; 39 days on market.

$2,250,000. South Beach: 2 BR, 2 BA, corner penthouse at The Infinity; 42nd floor, panoramic views, doorman building, private deck, 1 pkg. 10% below asking price; 13 days on market.

$1,865,000. Potrero Hill on 18th: 3 BR, 2.5 BA, renovated Victorian house; 2600 sq.ft., $717/sq.ft., bay and city views, 1 pkg.

$1,749,000. West Portal on 15th: 2009, 4 BR, 3.5 BA house; 3321 sq.ft., $527/sq.ft., high Greenpoint rating, 2 car pkg w/charging station. 100% of asking; 6 days on market.

$1,739,000. Noe Valley on Day: 1909, 8-room, 3 BR, 2.5 BA Victorian home; 2218 sq.ft. $784/sq.ft., 2 car parking.

$1,693,000. Laurel Heights on Spruce: 5 BR, 3.5 BA, Historic Registry Victorian; 2662 sq.ft., $636/sq.ft., 2 pkg. Off-market sale.

$1,649,000. Jackson Square: 2006, 3 BR, 2.5 BA full-floor condo; 2040 sq.ft., $808/sq.ft., private terrace, 1 pkg, city views, $898/month HOA dues. 4% below asking price; 159 days on market.

$1,630,000. Golden Gate Heights on Ortega: 1974, 4 BR, 3.5 BA, contemporary house; 2900 sq.ft., $562/sq.ft., ocean-city-bridge views, 2 pkg. 4% below asking price; 147 days on market.

$1,625,000. Russian Hill on Larkin: 1914, 5-room, 2 BR, 2.5 BA condo in 13 unit building; 1273 sq.ft., $1277/sq.ft., panoramic GG Bridge views, 1 pkg, $394/month HOA dues.

$1,600,000. Inner Richmond on 10th: 3-level, 11-room, 4 BR, 3.5 BA house; 2577 sq.ft., $621/sq.ft., "massive contemporary remodel", 1 pkg. 7% above asking price.

$1,600,000. NoPa on Shrader: 4 BR, 3.5 BA, top-floor Edwardian condo; 3169 sq.ft., $505/sq.ft., roof garden, 2 pkg. 100% of asking price; 24 days on market.

$1,595,000. Eureka Valley on Grandview: 1946, 3-story, 3 BR, 2.5 BA house; 2315 sq.ft., $689/sq.ft., bay and downtown views, 2 pkg. 11% above asking price; 17 days on market.

$1,565,000. Inner Mission on Hampshire: 2001, 2-story, 3 BR, 3BA, townhouse condo; 2870 sq.ft., $545/sq.ft., fantastic views, 2 terraces. 13% below original price; 65 days on market.

$1,529,000. Ashbury Heights on Clifford Terrace: 3 BR, 2.5 BA house; 2135 sq.ft., $716/sq.ft., deck, fish pond, 2 car pkg.

$1,500,000. Glen Park on Surrey: 2007, 3-level, 3 BR, 3 BA, contemporary house; 2521 sq.ft., $595/sq.ft., view deck, 1 pkg. 100% of asking; 40 days on market.

$1,496,000. Corona Heights on Saturn: 1957, 4 BR, 3 BA, contemporary house; 1900 sq.ft., $787/sq.ft., city lights view, view deck, 2 pkg.

$1,465,000. Forest Hill on Taraval: detached, 4 BR, 2.5 BA, traditional house; 2426 sq.ft., $604/sq.ft., 1 pkg. Closed at 6% above asking price.

$1,450,000. Nob Hill on Jones: 1929, 7-room, 2 BR, 2 BA condo in Clay-Jones; 18th floor, panoramic bay and city views, 1475 sq.ft., $983/sq.ft., 1 pkg, $1142/month HOA dues. 100% of asking price; 16 days on market.

$1,365,000. Presidio Heights on Sacramento: 1912, 6-room, lower-level, 3 BR, 1.5 BA, Arts & Crafts condo; 1617 sq.ft., $844/sq.ft., deeded garden, 1+ pkg. 2% below asking price; 55 days on market.

$1,348,000. Eureka Valley on Hancock: 1924, 3 BR, 2 BA, Marina-style house; 2000 sq.ft., $674/sq.ft., 2 pkg. 3% below asking price; 15 days on market.

$1,340,000. Financial District on Market: 2 BR, 2 BA condo in Ritz Carlton; 23rd floor, 1660 sq.ft., $807/sq.ft., Union Square & bay views, 1 pkg, $2621/month HOA dues. 1% below asking price.

$1,310,000. Inner Sunset on 8th: 1922, 4 BR, 2.5 BA, Edwardian house; 2790 sq.ft., $470/sq.ft., 1 pkg. 2% over asking price; 17 days on market.

$1,300,000. Anza Vista on Fortuna: 1948, 7-room, 2 BR, 2 BA house; 2337 sq.ft., $556/sq.ft., downtown views, deck, 2 pkg. 4% over asking price; 19 days on market.

$1,262,000. Potrero Hill on Carolina: 2002, North-slope, 3 BR, 3 BA contemporary home; 1872 sq.ft., $674/sq.ft., stunning downtown views, 1 pkg.

$1,125,000. Central Richmond on 30th: 1927, 8-room, 4 BR, 2.5 BA, Marina-style house; 2500 sq.ft., $446/sq.ft., 2 pkg. 6% below original price; 55 days on market.

$1,120,000. South Beach at The Towers: year 2000, 2 BR, 2 BA condo; 1167 sq.ft., $960/sq.ft., bay and marina views, huge view terrace, $814/month HOA dues. 2% over asking price; 40 days on market.

$1,040,000. St. Francis Wood on Yerba Buena: 1924, 3 BR, 1.5 BA house; 1612 sq.ft., $645/sq.ft., 1 pkg. 5% below asking price; 118 days on market.

$1,030,000. Haight Ashbury on Masonic: top floor, 5-room, 2 BR, 2 BA, Victorian condo; "historically significant", 1596 sq.ft., $645/sq.ft., 1 pkg. 8% over asking price; 5 days on market.

$1,020,000. Midtown Terrace on Midcrest: 1996, 6-room, 3 BR, 3.5 BA house; 1908 sq.ft., $535/sq.ft., 180 degree bay and ocean views, 2 decks, 1 pkg. 2% over asking price; 34 days on market.

$1,006,000. Lone Mountain on Anza: 3 BR, 2 BA, detached, Spanish-Med house; 2028 sq.ft., $523/sq.ft., trust sale, 1 pkg. 12% below original list price; 206 days on market.

$1,000,000. Noe Valley on Day: 3 BR, 2 BA, 6-room, Victorian house; 1286 sq.ft. with expansion potential, $778/sq.ft., 2 pkg. 26% over asking price; 28 days on market.

$1,000,000. Marina on Beach: top floor, 1929, 5-room, 2 BR, 2 BA, Spanish-Med condo; 1515 sq.ft., $660/sq.ft., 1 pkg, $650/month HOA dues.

$985,000. Cow Hollow on Greenwich: 3 BR, 2 BA, TIC townhouse; 1650 sq.ft., $597/sq.ft., 1 pkg, $465/month HOA dues. 100% of asking; 45 days on market.

$940,000. Duboce Triangle on Henry: 1982, top-floor, 2 BR, 2 BA condo; 1391 sq.ft., $676/sq.ft., south deck, 1 pkg, $390/month HOA dues. 18% over asking price; 30 days on market.

$905,000. Hayes Valley on Buchanan: top-floor, 3 BR, 1 BA, Edwardian condo; 1578 sq.ft., $574/sq.ft., deck, 1 pkg. 3% over asking price; 41 days on market.

$873,000. Pacific Heights on Clay: 1962, top-floor, 3 BR, 2 BA condo in 12 unit bldg; 1300 sq.ft., $672/sq.ft., shared laundry, 1 pkg. 9% over asking price; 15 days on market.

$850,000. Bernal Heights on Coleridge: 1947, 3 BR, 2 BA house; 1358 sq.ft., $626/sq.ft., view deck, 1 pkg. 11% over asking price; 27 days on market.

$845,000. Miraloma Park on Rockdale: 3 BR, 3 BA, Spanish-Med house; 1770 sq.ft., $477/sq.ft., trust sale, 2 decks, $39,000 pest report, 2 pkg. 11% below asking price; 99 days on market.

$845,000. Diamond Heights on Gold Mine: 1966, 6-room, 3 BR, 2.5 BA house; 1964 sq.ft., $430/sq.ft., sweeping views, tenant occupied, 2 pkg. 108 days on market.

$844,000. Mission Dolores on 17th: 1993, 6-room, 1st floor, 3 BR, 2 BA, contemporary condo; 1242 sq.ft., $680/sq.ft., 1 pkg, $300/month HOA dues. 6% over asking price; 42 days on market.

$820,000. Lake Street on 25th: 1930, 5-room, 2 BR, 2 BA condo; 1300 sq.ft., $631/sq.ft., panoramic views, 1 pkg, $460/month HOA dues.

$806,000. Lake Shore on Berkshire: 1953, 6-room, split-level, 3 BR, 2 BA house; 1686 sq.ft., $478/sq.ft., trust sale, 2 pkg. 3% over asking price; 33 days on market.

$799,000. Central Sunset on 35th: 1932, 2 BR, 2 BA, Spanish-Med Rousseau house; 1740 sq.ft., $459/sq.ft., tenant occupied, 2 pkg. 100% of asking price.

$785,000. SoMa on Natoma: 1906, top-floor, 3 BR, 2 BA, Victorian condo; 1525 sq.ft., $515/sq.ft., 2 pkg, $200/month HOA dues. 1% over asking price; 35 days on market.

$780,000. South Beach on Beale: 2 BR, 2 BA condo at the BridgeView; bank sale, 1074 sq.ft., $726/sq.ft., outstanding views, 24-hour doorman, 1 pkg. 4% over asking price; 12 days on market.

$775,000. Noe Valley on Douglass: 1910, 2 BR, 1 BA, Victorian house; 1050 sq.ft., $738/sq.ft., expansion potential, deck, 2 pkg. 11% below original asking price; 171 days on market.

$765,000. North Beach on Francisco: 2001, 2-level, 2 BR, 2 BA, loft-style condo in the Malt House; 1033 sq.ft., $741/sq.ft., 1 pkg, $590/month HOA dues. 2% over asking price; 36 days on market.

$757,000. Parkside on 22nd: 1939, tunnel-entrance, 7-room, 3 BR, 2 BA house; 1509 sq.ft., $502/sq.ft., 1 pkg. 8% over asking price; 27 days on market.

$755,000. Outer Richmond on 37th: 1924, 6-room, 2 BR, 2 BA house; 1750 sq.ft., $431/sq.ft., 2 pkg. 2% over asking; 29 days on market.

$700,000. Outer Richmond on 38th: 1925, 2 BR, 1 BA house; in-law apartment, 1450 sq.ft., $483/sq.ft., 1 pkg.

$660,000. Potrero Hill on Kansas: 2007, 4-room, 2 BR, 2 BA condo in 138 unit complex; 1077 sq.ft., $613/sq.ft., 1 pkg. 2% below asking price; 121 days on market.

$643,500. Inner Sunset on 17th: 1926, 6-room, 2 BR, 1 BA, Marina-style condo; 1550 sq.ft., $415/sq.ft., 1 pkg, $358/month HOA dues.

$620,000. Bernal Heights on Peralta: 1940, 6-room, 3 BR, 2 BA house; bonus room and bath, 1200 sq.ft., $517/sq.ft., 1 pkg.

$610,000. Pacific Heights on Scott: top-floor, 4-room, 1 BR, 1 BA, Edwardian condo; 748 sq.ft., $816/sq.ft., no pkg, $250/month HOA dues. 11% over asking price; 21 days on market.

$610,000. Merced Heights on Garfield: 2 BR, 1 BA house; in-law apartment, 1287 sq.ft., $474/sq.ft., ocean view, 1 pkg.

$605,000. Nob Hill on Broadway: 1982, 5-room, 2 BR, 2 BA condo; bank sale, 1097 sq.ft., $552/sq.ft., patio, 1 pkg, $631/month HOA dues. 5% over asking price.

$600,000. Sunnyside on Mangels: 1961, 8-room, 4 BR, 3 BA house; short sale, 1520 sq.ft., $395/sq.ft., 2 pkg.

$600,000. Outer Parkside on 48th: 1954, 6-room, 3 BR, 2 BA house; 1195 sq.ft., $502/sq.ft., ocean view, big deck, 1 pkg. 100% of asking price.

$595,000. Inner Richmond on 4th: 1907, 2 BR, 1 BA condo; bank sale, bonus rooms, 1314 sq.ft., $453/sq.ft., 1 pkg.

$580,000. SoMa on 8th: 1997, 1 BR, 2 BA, live-work loft/condo; probate sale, 1369 sq.ft., $424/sq.ft., 1 pkg.

$588,000. Outer Sunset on 43rd: 1954, 3 BR, 1.5 BA condo; 1235 Sq.ft., $476/sq.ft., ocean view, 2 pkg. 18% over asking price; 23 days on market.

$560,000. Lower Pacific Heights on Bush: 2 BR, 2 BA TIC; Smart Car included in sale, 1100 sq.ft., $509/sq.ft., $406/month HOA dues.

$536,000. Buena Vista Park on BV: 1986, 3-room, 1 BR, 1 BA condo; stunning downtown views, 734 sq.ft., $730/sq.ft., 1 pkg, $578 HOA dues.

$510,000. Crocker Amazon on Chicago: 1925, 5-room, 2 BR, 1 BA house; 1100 sq.ft., $464/sq.ft., large lot, 2 pkg. 3% over asking price; 30 days on market.

$510,000. Outer Mission on Alemany: 1940, 2 BR, 1 BA house; bonus room and bath, 1200 sq.ft., $425/sq.ft., 1 pkg. 3% over asking price; 33 days on market.

$488,000. South Beach on Berry: 2007, 1 BR, 1 BA condo at Park Terrace; short sale, 803 sq.ft., $608/sq.ft., 1 pkg, $468/month HOA dues.

$485,000. Excelsior on Dublin: 1944, 6-room, 2 BR, 2 BA house; trust sale, 1295 sq.ft., $375/sq.ft., 1 pkg. 22% over asking price.

$460,000. Bernal Heights on Nevada: 2 BR, 2 BA house; "contractor's special", bonus rooms, 1164 sq.ft., $395/sq.ft., 1 pkg.

$450,000. Ingleside Heights on Ramsell: 1961, 3 BR, 2 BA house; short sale, 1319 sq.ft., $341/sq.ft., 2 pkg.

$410,000. Oceanview on Montana: 1955, 5-room, 2 BR, 1 BA house; trust sale, 1050 sq.ft., $390/sq.ft., full basement, 2 pkg. 3% over asking price.

$380,000. Marina on Jefferson: 1991, 2-room condo; bank sale, 558 sq.ft., $681/sq.ft., no parking, $316/month HOA dues.

$380,000. Outer Richmond on La Playa: 1982, top-floor, 2 BR, 2 BA condo; 1043 sq.ft., $364/sq.ft., ocean views, 1 pkg. 9% over asking price; 29 days on market.

$348,000. Diamond Heights on Red Rock: 1972, 3-room, 1 BR, 1 BA condo in 396 unit complex; 830 sq.ft., $420/sq.ft., 1 pkg, $437/month HOA dues.

$329,000. Downtown on O'Farrell: 1930, 1 BR, 1 BA, Art Deco condo in The Hamilton; 945 sq.ft., $348/sq.ft., large bonus room, no parking, $723/month HOA dues. 11% below original asking price; 246 days on market.

$295,000. Bayview on Innes: 1927, 6-room, 2 BR, 1 BA house; bank sale, 1413 sq.ft., $209/sq.ft., 1 pkg. 16% over asking price; 24 days on market.

BR = bedrooms, BA = baths, days on market = the days between going on market and being designated "pending sale, contingencies removed". Homes that sold at or over asking price will typically have accepted offers within 7 to 14 days of going on market (commonly after receiving multiple offers), even if it may have taken additional weeks to remove contingencies of sale and be designated "pending".

Median price is that price at which half the sales occurred for more and half for less. It may be and often is affected by other factors besides changes in value, such as changes in buying patterns or available inventory.

Square footage is based on "livable space", which may be measured in different ways, but should not include decks, patios, yards, garages, unfinished basements and attics, or rooms built without permit ("bonus rooms" and "in-law apartments"). Square footage figures are often unreported or unreliable.

All median and average statistics should be considered approximations, and it is unknown how they apply to any specific property.

All data from sources deemed reliable but may contain errors and is subject to revision.

May 2012 Copyright Paragon Real Estate Group |

More information here

More information here

Trends in Median Sales Prices for Non-Distressed 2-Bedroom Condos

in Selected SF Neighborhoods2012 Numbers reflect 2nd Quarter Sales Only

Trends in Median Sales Prices for Non-Distressed 2-Bedroom Condos

in Selected SF Neighborhoods2012 Numbers reflect 2nd Quarter Sales Only